Introduction

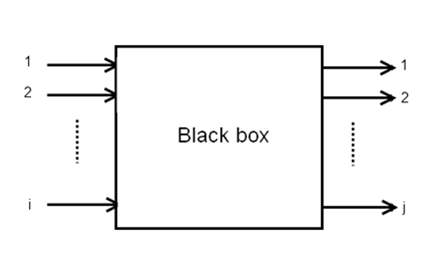

What Is a Black Box Model? A black box is a device, system, or object in science, computing, and engineering that generates meaningful information without providing details about its internal workings. The reasoning behind its findings is still "in the dark." Financial reviewers, hedge budget directors, and investors may utilise software established on a black-box prototype to convert data into a profitable investment plan.

The growth of black box models in various fields and the increasing sophistication of AI and ML technologies have contributed to the mystery surrounding these tools. Potential consumers in various fields view black box models with scepticism. According to research discussing their applications in cardiology, the "black box is shorthand for models that are sufficiently complicated that they are not straightforwardly interpretable to humans."

How Does the Black Box Model Work?

Before the financial markets adopted the black box model, it was used mostly in sectors like science, computers, and engineering to describe the connections between inputs and outputs of systems. The investment decision-making process in the financial markets is often called a "black box model." A human memory, brain, computer algorithm, or transistor all fit this concept. Yet, investors' propensity to cloak the true risk of investments beneath the guise of computer programmes and technology has prompted concerns about the systematic hazards that the black box model introduces to the financial markets. The black box characterises the stimulus-response dynamic between consumers in model consumer behaviour theory.

The Financial Sector's Black Box Model

The rising use of black box tactics within the financial markets introduces new dangers. Black box models don't inherently introduce danger, but they raise governance and ethics issues. Investors should be wary of advisors that use black box strategies because they can hide the risks associated with the assets they recommend to their clients under the guise of protecting their intellectual property. The lack of transparency prevents investors and regulators from assessing the level of risk being taken on. What are the benefits of black box approaches, and what are the drawbacks, if any? It's important to recognise that there are many perspectives.

Who Makes Use of Financial Models with a Black Box?

Black box models employed in the analysis of assets have had periods of popularity and disfavour over time. Whether or not the markets are doing well often affects this. Due to the potentially catastrophic nature of black box approaches, they are singled out for scrutiny during times of market volatility. It may not be until catastrophic losses have occurred that the true extent of the risks being taken become apparent.

"Black box" models, distinguished by their reliance on complex mathematical approaches, are becoming more widespread as computing power, big data applications, artificial intelligence, and machine learning capabilities continue to advance. These developments contribute even further to the secrecy surrounding black box models. Black box models are often utilised in managing investment strategies by various financial organisations, including hedge funds and some of the largest investment managers in the world.

The Evolution of the Black Box Model through the Years

The effectiveness of the black box model in the financial markets is extremely dependent on the current state of the markets and the stage that the market cycle is in at the time. If used during times of substantial market volatility, black box models can create extra risks and perhaps bring about a complete market collapse. The flash crisis of 2015, the portfolio insurance event of 1987, and the implosion of long-term capital management in 1998 are examples of the havoc that black box techniques may wreak.

Many individuals have suggested that black box solutions shouldn't be utilised because of the risks associated with using them. The complexity of black box models has increased due to technological improvements in domains such as machine learning and data analytics, in addition to other fields that are closely related to these fields. Institutional and hedge fund investors continue to rely on these tactics when confronted with complicated problems.

Conclusion

The use of black box models in developing software for applications in industries other than finance, such as banking, healthcare, and engineering, is becoming increasingly prevalent. At the same time that the capabilities of machine learning are increasing, the workflows of the black box model are becoming more complicated. They are getting more and more opaque. To put it another way, we rely on their findings without fully knowing how those findings were arrived at.