The United States Treasury marketed What Are Series HH Savings bonds through 2004. Although investors cannot purchase new Series HH savings bonds, holders may still have access to unmatured Series HH bonds in their portfolios. U.S. Government Series HH Bonds paid coupon interest semiannually for 20 years and were non-marketable savings instruments. The coupon rate was fixed for the first ten years of the bond's existence, and then the U.S. Treasury adjusted it for the remainder of the bond's term. Government sales of Series HH bonds ended on August 31, 2004, after which they may no longer be purchased from the United States Treasury. Investment returns on bonds that haven't yet matured will keep coming even after the bond's original maturity date has passed.

Series HH Bonds: An Overview

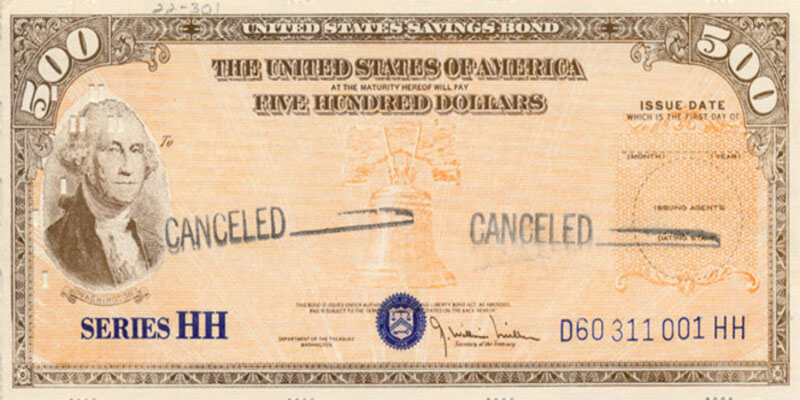

Long-term savers will appreciate the flexibility and safety of the Series HH Savings Bond Program. Beginning in November 1982, Series HH bonds may be obtained exclusively via the reinvestment of existing matured Series H bonds or through the exchange with Series EE/E bonds. Most bond buyers utilized the interest earned until maturity as little more than a retirement savings supplement. The various bond denominations became available to purchase Series HH bonds, all at face value.

- $500

- $10,000

- $1,000

- $5,000

Investors in this series of bonds were issued physical copies of their bond certificates. Interest accrued on this bond series was not applied to the principle. Hence there was no opportunity for value growth. Direct deposits into the bondholder's account occurred semiannually. There were early redemption and exchange possibilities for the bond after the first six months.

Series HH Savings Bonds: What They Are And Some Examples

U.S. Treasury Series HH bonds are indeed a savings bond program that distributes interest to participants every month. The interest earned was not reinvested as it is with Series EE savings bonds. Those who purchased Series HH bonds benefited from steady interest payments. The bond denominations available were $500, $1,000, $5,000, as well as $10,000.

How Do Savings Bonds In Series Hh Function?

The Series HH savings bond documentation was sent to the buyer once the bond was purchased. Investors who wished to pay out their bonds early had to return the paper certificates. Interest on Series HH bonds was paid semiannually while an investor held the bond. The bondholder regularly received interest payments in direct deposits to their bank accounts for as long as they owned the bond. Series HH savings bonds, like other Treasury bonds, were guaranteed by the full confidence and credit of the United States government, thereby offering one of the lowest levels of uncertainty for investors. The required minimum holding period for Series HH savings bonds was six months. Following that date, bondholders can sell their bonds for their homemade facial value anywhere at any time.

Hh Savings Bonds Interest Rate

Series HH savings bond borrowing costs were adjusted every six months. An investor who purchased a Series HH bond did so at a fixed interest rate for the first ten years of the bond's life, after which the rate was variable for the following ten years. Twenty years after purchase, a Series HH savings bond reaches maturity and no longer accrues interest. When the time comes, the investor gets back their initial investment plus interest. Interest is still being paid on certain Series HH bonds, even though they were last issued in 2004. Series HH savings bond returns are federally taxable and must be recorded in the year obtained but are exempt from state and municipal taxes.

What Does This Mean For Individual Investors?

Since Series HH savings bonds have a maturity date of August 20, 2024, and the last of those alternative investments will mature in 2024, it is possible that some Series HH savings bonds have yet to mature. However, the early redemption feature of these bonds means there may be fewer of them now than when they were issued in the early 2000s. Still, outstanding bonds will accrue interest unless they mature 20 years beyond their respective issuance dates.

Conclusion

A previously issued savings bond inside the United States with a set interest rate for ten years that is not subject to state or municipal taxes. Twenty years after being issued, these bonds matured and paid face value. They could not be sold but rather retained or redeemed. After ten years, their interest rate typically decreased to 1.5%, significantly lagging behind inflation. In 2004, trading of Series HH Bonds ceased. Similar concept: Series H bond.