If you were under 50 in 2021, the most you may contribute to your Roth IRA is $6,000; if you are 50 or older, the most you can contribute to your Roth IRA is $7,000. If you are a single filer, you need to have earned a Modified Adjusted Gross Income (MAGI) of $140,000, and if you are married and filing jointly, you need to have earned $208,000. This determines whether or not you are qualified to open a Roth IRA account. Withdrawals from a Roth IRA are not subject to taxes, and there are no mandatory RMDs after the account holder reaches a specific age. This is one of the primary benefits of a Roth IRA. Roth individual retirement accounts (IRAs) have several drawbacks, including income restrictions and a reduction in current income due to increased tax liabilities caused by contributions to such accounts.

Roth-IRA Basics

Initially referred to as "IRA Plus" accounts, Roth IRAs were later given their current name in honour of Delaware Senator William Roth, who was the driving force behind the legislation that established them. Roth IRAs are different. Roth IRA funds can be withdrawn at any time and in any frequency after 59.5 years without paying additional taxes, unlike the latter, which requires RMDs beyond a specific age. Traditional and Roth IRAs share many similarities. Like standard IRAs, they can be started at any age. Rollover company-sponsored retirement plans into Roth IRAs and pass them on tax-free. Roth IRAs allow securities trading but need cash contributions. Thus, you cannot contribute equities, bonds, or property to your account. Earned income—from work or self-employment—must be used to make them. Other income is prohibited. You cannot contribute stock profits to your Roth IRA. Roth IRAs are tax-deferred so that trade gains will be taxed later.

Roth IRAs: Pros and Cons?

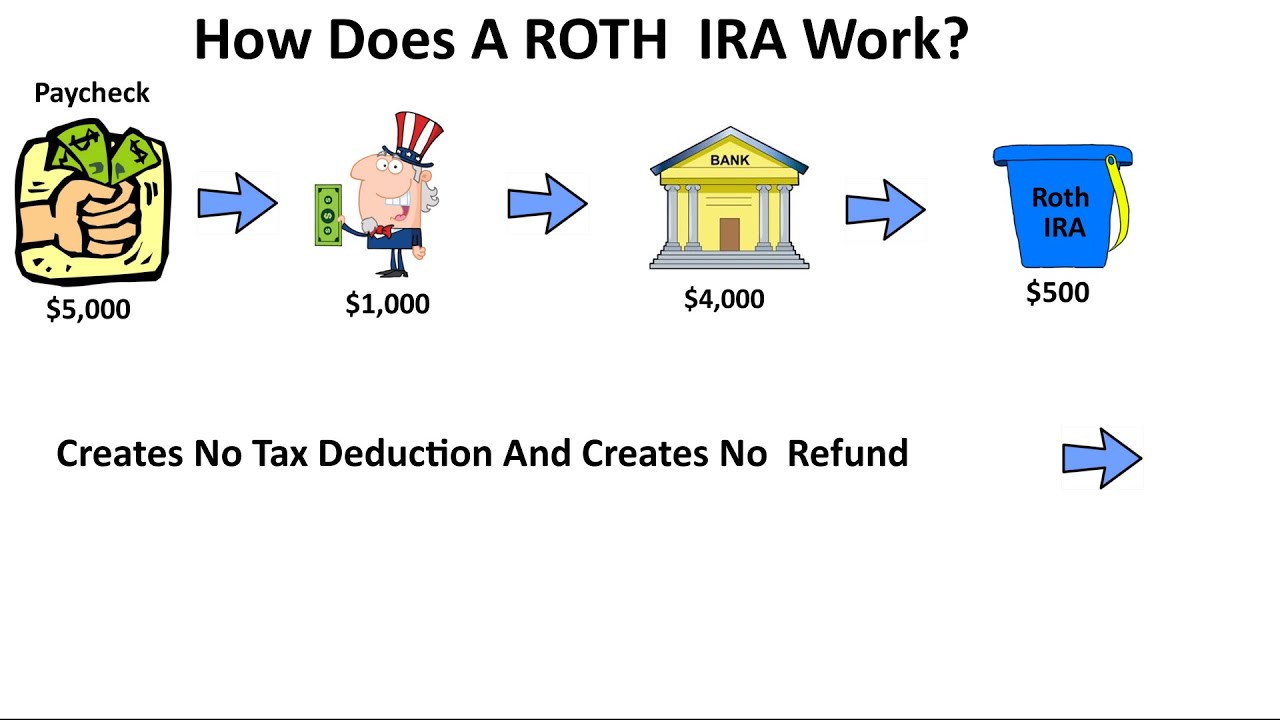

Roth IRAs, like standard IRAs, have significant benefits for retirement planning. Roth IRA income is tax-free. Roth IRA account holders can withdraw cash tax-free if they are over 59.5 years old and have contributed to their accounts for at least five years. Roth IRA contributions are made with after-tax income. Roth IRAs can benefit low- and middle-income households depending on income. Saver's Credit gives Roth IRA holders tax credits of 50%, 20%, or 10% of MAGI, depending on income. In 2021, married couples filing jointly with an adjusted gross income under $39,500 can receive a 50% Roth IRA contribution credit. Roth IRAs have no RMDs. RMDs must start at 72 in a typical IRA. If not, withdrawals cost regular rates. Roth IRAs allow withdrawals at any time. Roth IRA funds can be carried over into trusts or raised using monies from other financial instruments like company-sponsored retirement plans. Special Trusts can pass on Roth IRA funds' tax-free status. Roth IRA Drawbacks:Roth IRA contributions are non-deductible because they are made with after-tax money. Contributions reduce your income without providing any rewards. For instance, you made the maximum Roth IRA contribution of $6,000 for a single filer and earned $80,000 after taxes. Your annual income drops to $74,000. Roth IRAs limit income. The MAGI provision limits who can open them. You cannot start a Roth IRA if your annual income exceeds the MAGI. This is unlike IRA accounts, which anyone can open regardless of income.

Roth IRA Setup

Visit a bank or brokerage with evidence of income and identification to start a Roth IRA. Consider its aim before opening an account. Most people use Roth IRAs for retirement planning. Mutual funds, equities, bonds, ETFs, or any combination can help you attain this aim. Ask yourself crucial account-purpose questions. These questions include: Your account will trade how often? Instead of a bank, consider a brokerage account if you trade often. Trading fees matter too. Lower fees encourage trading. Risk tolerance? Retirement accounts store money for safekeeping. Thus, speculative assets and instruments are limited. A Roth IRA portfolio might include conservative investments like mutual funds, which offer fixed returns with low risk, and growth equities. Based on your risk tolerance, you can split your Roth IRA funds between conservative and riskier investments.